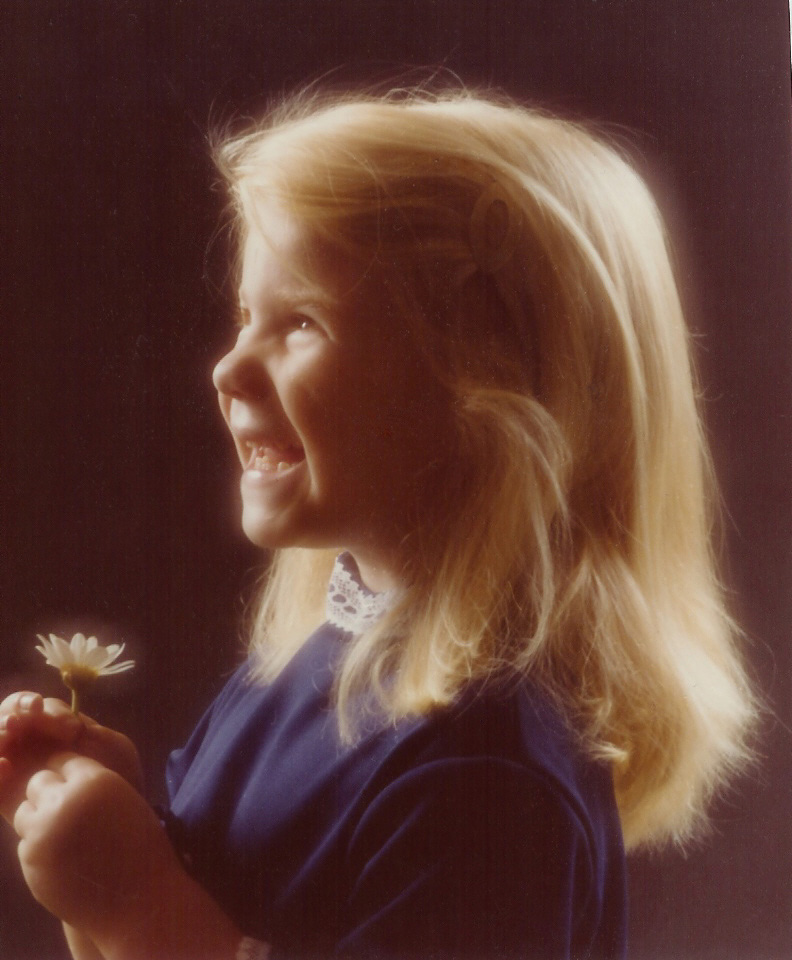

Hi! My name is Kimberly, and yes … that is me then and now! :0)

I would love to take a few minutes to tell you a little about myself and how The Kidz Money Project was born. I grew up in suburban Dallas with two entrepreneurial parents, so it was no surprise I followed in their footsteps. With my mother’s encouragement, I started my first business during my sophomore year at Southern Methodist University (SMU). With a mind for business, it was time to find my passion, and that epiphany came about a year after graduation.

THE REAL WORLD

That first year on my own after college was an eye-opener in so many ways. First, just learning what the real world was like … much different than the academic world I was used to. However, it was conversations with my friends that started to stick out. We were all more or less in the same place in our lives … degrees, first real jobs, grocery shopping, paying bills entirely on our own, etc., but our money conversations seemed to differ significantly.

During that first year after graduation and talking with friends about life, money, marriage, kids, etc., I soon realized I had a different relationship with money than most of them. While I had already purchased my first home and started a retirement account, most of my friends were just trying to figure out how to pay the rent, and I didn’t understand it. These were all knowledgeable individuals who had either graduated from college or soon would be. How could our money skills be so different?

FINANCIAL LITERACY

I had never really thought about where my financial literacy had come from before, and I think I naturally thought I learned it in school like so many other things … reading, writing, arithmetic, etc. However, with more thought, I realized my financial knowledge had come from my mother. Not the sit me down at the kitchen table with a book-type conversation, but years and years of talking to me about money … explaining “How Money Worked.”

So, why didn’t my friend’s parents have these conversations with them?

That part of the equation took me a bit longer to figure out. It wasn’t that my friend’s parents were terrible or uninvolved people; it was just that no one ever taught them about money when they were growing up. They were still figuring it out as life rolled right on along, just like most people.

THANK YOU MOM!

We spend 12 to 16 years in school, yet there are really no financial literacy courses offered. You need to be a finance major in college to learn about money. How is that possible? While there should be more money skills taught in schools, I believe most of this topic will be learned in the home … no matter what is taught at school. Kids watch their parents and replicate what they are doing, no matter what they are taught.

While my mother taught me many life lessons, making sure that I understood money has given me an incredible leg up in life. I started saving while still in college, and compounding interest has made it where I’m not worried about my financial future. Talk about a load off!

This feeling of security drove my passion to start The Kidz Money Project. I want parents to understand what an incredible gift they can give their kids now that will continue throughout their lifetime. Stuffed animals, toys and even cars come and go, but this gift lasts forever.

I know many parents feel they lack the financial knowledge to talk to their kids about money. Honestly, it doesn’t take that much time, and any knowledge you may be missing can be learned. Believe it or not, you know most of it now; you may just not know how to convey it to your kids … that is where I want The Kidz Money Project to come in.

The Kidz Money Project is about helping parents with tools and resources to talk to their kids. Give them a roadmap of when and how to talk to their kids about money. Show parents how to help their kids not get into tens or even hundreds of thousands of dollars in debt by taking out student loans. Believe it or not, it is possible to graduate debt-free.

Follow along with us … ask questions … we are here to help!

Kimberly Evans Sulfridge is the owner of the Annbry Group, LLC, a Five Rings Financial Agency.

www.kimberlysulfridge.com

Licenses, Degrees & Certifications:

General Lines Agent – Life, Accident, Health, HMO, Property & Casualty

B.A. of Psychology – Southern Methodist University

Ramsey Solutions Financial Coach Master Training