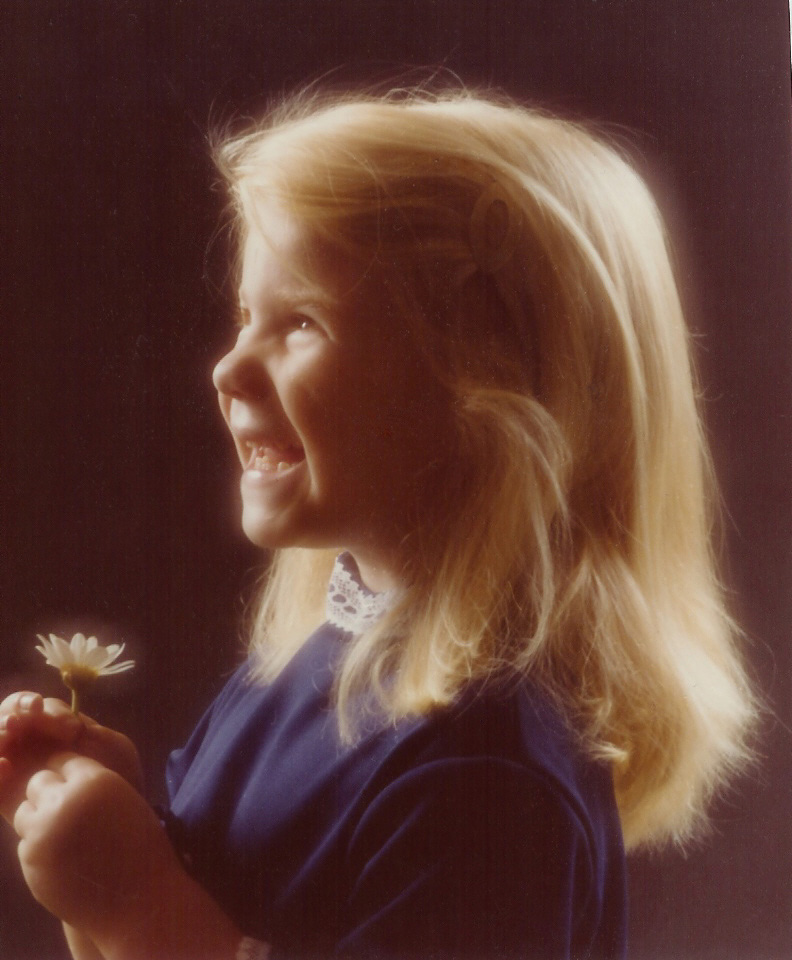

Hi! My name is Kimberly, and yes… that’s me—then and now! :0)

I’d love to take a few minutes to share a little about myself and how The Kidz Money Project came to life.

I grew up in suburban Dallas with two entrepreneurial parents, so it was no surprise that I eventually followed in their footsteps. With my mom’s encouragement, I started my first business during my sophomore year at Southern Methodist University (SMU). I had a head for business—but I still needed to find my why. That epiphany came about a year after graduation.

THE REAL WORLD

That first year out of college was an eye-opener. Adjusting to adult life—real bills, real responsibilities—was a big shift. But what really stood out were the conversations I was having with friends. We were all in the same season of life: degrees in hand, starting careers, learning to manage everything on our own. But when it came to money… our experiences were vastly different.

While I had already purchased my first home and opened a retirement account, many of my friends were just trying to make rent. It didn’t make sense at first—we were all smart, educated people. So why were our financial paths so different?

FINANCIAL LITERACY

That’s when it hit me: I had learned about money growing up. Not through formal classes or a school curriculum—but through everyday conversations with my mom. She taught me how money works—not in a sit-down lecture kind of way, but through years of consistent, simple, real-life lessons.

Then I started asking: why didn’t my friends have those same conversations at home?

Over time, I realized it wasn’t because their parents didn’t care. It’s just that no one ever taught them. They were still figuring it out themselves—just like most people.

THANK YOU MOM!

We spend 12 to 16 years in school and still never learn the basics of managing money. Unless you’re a finance major, it’s often never taught. That’s a problem. While I believe schools should offer financial education, the truth is: kids will learn the most from what they see at home.

That’s why I’m so grateful to my mom. Her guidance helped me start saving early, and that gave me a huge head start. Thanks to compounding interest, I’m not worried about my financial future—and that kind of peace of mind is priceless.

That feeling of financial security—and knowing where it came from—is what inspired me to launch The Kidz Money Project.

I want parents to realize what an incredible gift they can give their children by teaching them about money. Toys, games, even cars will come and go—but financial knowledge lasts a lifetime.

I know many parents feel like they don’t know enough to teach their kids about money—but I promise, you don’t need to be a financial expert. You probably know more than you think. And anything you’re not sure about? You can learn.

That’s where The Kidz Money Project comes in. We’re here to provide tools, resources, and a simple roadmap for raising financially savvy kids—without overwhelm or shame. We’ll walk with you as you learn how to help your kids make smart decisions, avoid unnecessary debt, and build a strong financial future—possibly even graduating college debt-free.

Follow along. Ask questions. Let’s learn together.

We’re here to help.

Kimberly Evans Sulfridge is the owner of the Annbry Group, LLC, a Five Rings Financial Agency.

www.kimberlysulfridge.com

Licenses, Degrees & Certifications:

General Lines Agent – Life, Accident, Health, HMO, Property & Casualty

B.A. of Psychology – Southern Methodist University

Ramsey Solutions Financial Coach Master Training